FreshBooks Review 2023: Features & Pricing

Content

You can include customized takes note of the receipt or in your email. Wave is a solid choice for small businesses looking for free accounting software. In the same vein, FreshBooks might be limiting for growing businesses that have multiple people working in the software. Regardless of which plan you choose, your accountant will not have access to a full audit trail.

This user does not like the hassle of arguing with clients for payments. Now, he does not have to call his client to collect money, only to discuss a project. With FreshBooks, you and your team can effortlessly work together to ensure each task is done, targets are met more quickly, and outcomes are delivered more efficiently. This platform is designed mainly to help https://www.bookstime.com/articles/freshbooks small businesses enhance their productivity. FreshBooks’ project-related features are extensive, which include live chat, task deadline dates assigning, project status overview, file sharing, client rate/hour assigning, and many more. It is easy to manage your billing history as the app provides a lot of tools to help you keep track of past and current invoices.

Compare Accounting Software

QuickBooks Online has a limit of five users in its most popular Plus plan and 25 users in its Advanced plan. Wave, a free accounting software product, doesn’t place limits on the number of users or clients. Xero doesn’t cap the number of users or clients you can have, but it limits the number of invoices you can send in its lowest-tier Early plan.

That number jumps to 50 billable clients with the Plus plan and then an unlimited number for the Premium plan. While there are many accounting software options out there, FreshBooks is particularly well-suited for smaller businesses and companies with one main owner and operator. The offers that appear on the website are from software companies from which CRM.org receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear).

Feature comparison of FreshBooks vs QuickBooks

Its plans support businesses of all sizes, from self-employed freelancers and contractors to enterprises. While the Lite plan doesn’t limit the number of invoices you can send, the software only lets you bill five clients per month. If you bill more than five clients in a given month, you’ll be charged for the more expensive Plus plan, which includes up to 50 clients. You can also customize your invoice templates by adding your logo, colors, and other branding elements.

- FreshBooks is mostly used by freelancers and small businesses, and one of the common opinions is how easy the app makes billing for recurring invoices.

- The Plus plan allows users to send invoices to up to 50 billable clients.

- With FreshBooks, you’ll also be able to create invoices one by one or create recurring invoice templates, which are sent on a repeating basis.

- Freshbooks helps small businesses grow by automating accounting processes such as invoicing and expense tracking.

- Automatic permissions are set in FreshBooks, so you don’t have to worry about setting up permission levels when inviting team members.

- Wave Accounting is one of the best, most fully featured free accounting solutions for small businesses.

You’ll be able to utilize the automatic expense receipt capture to simplify the accounting of regular expenses such as meals and travel. FreshBooks accounting software gives you instant access to the tools you need to manage your finances. It’s perfect for everyone from self-employed professionals to growing business owners. FreshBooks can run on just about any web browser, including Google Chrome, Firefox, Internet Explorer, Microsoft Edge, Opera, Safari, Mobile Safari, and Mobile Chrome. To evaluate FreshBooks, we set up a free account, viewed a demo and created invoices within the software as part of our hands-on test project. Intuit QuickBooks Online is one of the oldest, most popular and most comprehensive accounting software in the world.

Reports

If you’re creating custom invitations, though, you can add the expense of the paper purchased to Cost of Goods Sold. Additionally, the software automatically categorizes expenses to simplify tax write-offs and cash-flow tracking. FreshBooks also runs frequent sales that lock in deep discounts for your first six months. FreshBooks is ideal for freelancers, self-employed professionals, and small businesses working with contractors. Consultants, SMB owners, creative agencies, marketing companies, and AEC firms are some of the more common users.

FreshBooks has also added numerous enhancements to invoices and the overall workflow. For example, a new Preview tab shows you how an invoice will look before you send it. It would be nice, though, if there were more invoice customization options.

FreshBooks : Features and Strengths

When we tested FreshBooks, we found that it offers all of the essential accounting features that small businesses need. We were particularly impressed by the software’s invoicing capabilities, which we found far superior to those of many competitors we reviewed. We tested the software extensively and found creating and sending professional invoices straightforward and effortless. Freshbooks helps small businesses grow by automating accounting processes such as invoicing and expense tracking. Their goal is to give the business owner back their time so that it can be devoted to core business activities, such as marketing and customer support.

Small Business Accounting Services in Chicago, IL CPA firm Skokie

Content

Brett is a QuickBooks, Xero, and Gusto HR and Payroll certified advisor. The A.C.T. Group, LLC in Chicago, IL North Shore specializes in offering tax strategies and financial planning to individuals, businesses, and organizations. The firm’s accountants provide bookkeeping assistance and QuickBooks services that include setup, training, support, and monthly reviews. They also handle personal and business tax preparation, non-profit audits, and business consultation. The A.C.T. Group extends its comprehensive accounting and tax services to clients with its additional offices in Wheaton and Downtown Chicago. It serves small businesses and individuals, as well as customers in the construction, technology, and real estate industries.

The steps involved with basic bookkeeping can be overwhelming depending on the size of your business and the number of transactions. If you no longer feel like you have control of your books, give us a call. We will manage your business finances and keep you on the right track. When Marcum merged in Melanson, Allan Koltin was the primary advisor to both firms.

Join The Team

All CPAs are certified by their respective states as having the education and training to perform professional accounting services. At Apex CPAs & Consultants near West Chicago, IL, we strive to have a diversified team with expertise in industries like manufacturing, retail, technology, importing, restaurants and hospitality, and more. With Apex, you’ll always have access to a CPA in West Chicago who knows your business inside and out. A CPA can collect and record your receipts, perform your payroll, make and accept payments on your behalf, and produce reports on your current financial status. Your local West Chicago CPA will work on these services throughout the year so your quarterly or annual taxes are smooth, easy, and accurate while finding all of the deductions and credits available to you.

Financial projects will allow your business strategy leaders to make decisions armed with accurate financial facts, and to understand whether your business is meeting its goals. Lastly, financial statement preparation includes cash flow statements, income statements, and balance sheets. They’re built from accurate bookkeeping and submitted for review by government officials. It is imperative that your business is able to accurately report its operations on financial statements, as investors and stakeholders will use financial statements to make decisions about your business. At Odoni Partners LLC, we are experts in not only one, but all of these areas. By working with us, we can provide you with a robust business analysis that can allow you to achieve future success.

Tax Guides

We can also forecast future cash flow based on past spending patterns. Of course, our analysis takes place in the context of your industry because every industry has varying needs. The number one reason that businesses fail isn’t because of a poor business idea–it’s simply learning to manage your assets effectively. Even if your business is not currently profitable, we can guide you towards cash flow positive.

One of the advantages of remote services is being able to help clients from the Atlantic to the Pacific. You have no shortage of options for small business accounting services, so why choose Lewis.cpa? Allan was quoted in IPA’s article regarding EisnerAmper’s private equity investment. Allan assisted Armanino in its acquisition of Drucker & Scaccetti, serving as principal advisor to both firms. Pinion announces merger with Anderson ZurMuehlen; Allan served as principal advisor to both firms.

Chicago Accounting Firm

Our accountants in Chicago concentrate on helping small businesses comfortably face the challenge of start-up and growth. A great relationship with your accountant leads to highly Running Law Firm Bookkeeping: Consider the Industry Specifics in the Detailed Guide managed financial data and reports you can use to take actionable steps. The right business decisions are fueled by great data and sound advice for your company’s success.

Our accountants, bookkeepers and tax advisors use QuickBooks Online to manage the books and financial records of our small business clients and real estate investors. At Massey and Company, CPA, our goal is to make sure the books remain clean and organized throughout the year, and are ready for tax preparation. Our focus include income taxes, sales taxes and international tax issues. Our tax accountants work closely with our small business clients to prepare and file their business taxes so that they feel involved and informed every step of the way. We assist our business clients with all tax matters that arise throughout the year.

Accounting and Bookkeeping Services You Can Trust

Our modern approach to small business accounting and tax services simplifies financial management for entrepreneurs and small business owners. We are a rapidly growing Certified Public Accounting and consulting firm in downtown Chicago and the Western suburb of Wheaton, IL. We provide accounting, 401k audits, tax and financial planning services in addition to a wide range of business and consulting services. Our individual tax preparation services include pickup and drop off services.

- Website builder for accountants designed by Build Your Firm, providers of accounting marketing services.

- These decisions can affect a broad range of issues, from equity arrangements and tax advantages to long-term financing and succession of ownership.

- The best results are achieved when there is a solid rapport between client and CPA.

- Massey and Company provides a full range of CPA tax and accounting services, including tax representation and tax debt relief solutions.

- Our accounting process is here to serve you, your small business, and your needs and goals.

We take you carefully through the tax preparation process, so you feel comfortable and informed. We will advise you about any potential “red flags” in your return, so you don’t have to worry about the IRS. The Dolins Group is an accounting firm that serves clients located in the Chicago area. Established in 1993, the firm rebranded to its current name in 2011 after expanding its list of partners. Leonard Dolins, its founder, has been in the accounting industry since 1961. The firm provides a holistic approach to financial issues through its accounting and tax services.

How Much Does QuickBooks Cost?

Our internal case study compares the four QuickBooks Online versions across major accounting categories and functions to help you decide which one fits your needs. QuickBooks Self-Employed is not included in the case study because it is not a full double-entry bookkeeping system. If you are going to charge such exorbitant prices for your product, it better be perfect. Then, consider all the add-ons you get nickeled and dimed for and it’s hard to say it’s worth the cost. Services like Shopify, TSheets and MailChimp have integrated with QBO.

- The QuickBooks Online Simple plan costs $30/month and supports one user.

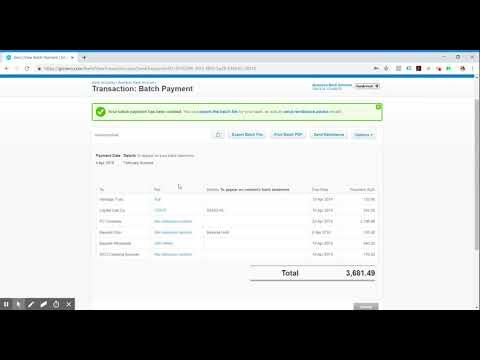

- Invoices can be sent manually or scheduled to be sent automatically on a recurring basis.

- QuickBooks calculates the sales tax rate based on date, location, type of product or service, and customer.

- There are no contracts, and all QuickBooks pricing plans can be tried out for a 30-day free trial, which is a great way to let potential customers see if it is the right option for them.

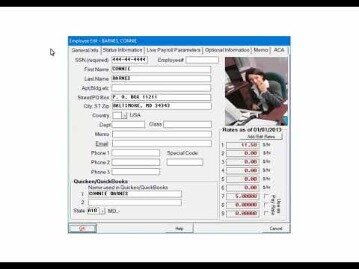

With QuickBooks Online, you can send, track and file 1099 forms for independent contractors. Automatic updating of 1099 forms ensures your company remains compliant with IRS requirements and provides your freelancers with the documentation they need to pay their taxes. Not nearly every accounting software platform we reviewed offers this functionality, and we saw its benefit for any business that hires freelancers immediately. QuickBooks Online Advanced is slightly better than Plus and the other QuickBooks Online plans in A/P and A/R because of its batch invoicing and expense management features. Batch invoicing allows you to create multiple invoices at once rather than creating them one at a time. This can be useful if you have many customers who need to be invoiced for the same products or services.

Standard checks begin at $46.26/per 50 checks; prices vary by check type and amount. Small-business owners who prefer to work on software that’s locally installed on their computers will appreciate the simplicity of QuickBooks Desktop Pro Plus. Users can switch plans or cancel without having to pay termination fees. Based on what you get in each plan tier, though, it is certainly competitive. Make sure that you know exactly what you need before you make a selection. Create customized tags and run reports to reveal the financial state of your business.

QuickBooks has an accounting tool specifically for freelancers called QuickBooks Online Self-Employed, which starts at $15 a month. QuickBooks Self-Employed tackles basic freelance bookkeeping features like expense tracking, receipt uploading, tax categorizing, quarterly tax estimating and mileage tracking. QuickBooks Online Simple Start is geared toward solopreneurs, sole proprietors, freelancers and other micro- and small-business owners. Its basic features include invoicing, online payment acceptance, 1099 contractor management and automatic sales channel syncing (for e-commerce business owners). With versions dedicated to contractor, manufacturing & wholesale, nonprofit, retail, and professional services, Enterprise is designed specifically for your industry. Industry editions provide specialized features, like customized chart of accounts and critical reports targeted to your type of business.

New Payroll Pricing

This service uses your existing QuickBooks Online accounting information to determine your eligibility for a loan. If you choose this funding option, there are no origination fees and no prepayment fees, but you will be expected to make weekly payments plus APR. Payments vary based on your loan amount, credit score, and term length. QuickBooks Online users can get access to QuickBook’s lending service — QuickBooks Capital. QuickBooks Capital is a working capital loan to help small business owners run their operations, whether that’s covering new hires, ordering inventory, making payroll, etc. In addition to the monthly subscription price, there are a few other QuickBooks Online charges to be aware of.

- There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

- A key added feature of the QuickBooks Essentials plan is the ability to manage unpaid bills and allocate billable time and expenses to a specific customer.

- The software includes at least 20 different pre-built report types, as well as custom reports in some plans.

QuickBooks offers more — and better — reports than nearly any other accounting software provider. With the Simple Start plan, QuickBooks’ software will generate cash flow statements, income Paid Telephone Bill Journal Entry statements and balance sheets. Users can also use it to create customized tags and reports that help you hone in on specific income and expense trends and up your business’s cash flow.

QuickBooks Online also integrates with third-party apps so you can connect the programs you already use. With automatic updates to your company’s ledger, the software enables you to invoice clients, view accounts receivable, and accept payments. Avoiding this costly error alone can justify QuickBooks Online pricing. To help you manage cash flow, QuickBooks enables you to track spending, profitability, and inventory. Your income and expenses are automatically tracked by the application, which also automatically categorizes them.

Advanced Pricing lets you control, customize, and automate your pricing, right from within QuickBooks. No more manual updates, so you can easily change your prices to keep that bottom line growing. You just set the price rules and Advanced Pricing will do the calculations.

QuickBooks Online Expert Services & Sales

Additionally, these discounts are only available if you skip the 30-day free trial. QuickBooks Online by Intuit is one of the top-rated and used bookkeeping and accounting software tools for all your financial management needs. It’s great if you want to work with a bookkeeper or accountant on a regular basis. This cloud-based solution means that there’s no installation required.

Contractors should also select Plus to track the profitability of individual projects. Other businesses should consider whether tracking P&L by class and location is worth the extra $30 per month. We are big supporters of cloud-based software—check out our post on Xero vs QuickBooks to see why.

Merchant Maverick’s ratings are editorial in nature, and are not aggregated from user reviews. Each staff reviewer at Merchant Maverick is a subject matter expert with experience researching, testing, and evaluating small business software and services. The rating of this company or service is based on the author’s expert opinion and analysis of the product, and assessed and seconded by another subject matter expert on staff before publication. Merchant Maverick’s ratings are not influenced by affiliate partnerships.

QuickBooks Support

However, self-employed persons should consider Self-Employed—unless they have an employee, which will require an upgrade to Simple Start. If your business is service-based without any inventory, then Essentials should provide everything you need while saving you $30 per month compared to Plus. QuickBooks Advanced has many bells and whistles compared to Plus, but there are no additional features that are crucial to good bookkeeping.

QuickBooks includes at least 20 types of prebuilt reports as well as custom reports in certain plans. Sign up for QuickBooks Time through Fourlane today and get 30% off. Easily track time, save on payroll, and manage your team on the go. Ditch the shoebox of receipts and let QuickBooks track potential tax deductions for you.

This influences which products we write about and where and how the product appears on a page. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. Mileage tracking is available on QuickBooks Self-Employed and QuickBooks Online on iOS and Android only. QuickBooks MTD software currently supports Standard, Cash and Flat Rate schemes. Businesses whose home currency is not GBP are currently not supported.

In stark contrast to QuickBooks Online, each Xero accounting plan includes basic inventory management and an unlimited number of users. Xero’s software is easily as user friendly as QuickBooks’ with a colorful, organized dashboard and highly reviewed apps for iOS and Android. It also has better customer service reviews than Intuit, even though Xero’s customer service is available via email only. An easier way to manage different prices for different customers is with the price levels feature in QuickBooks.

With QuickBooks Payments, you’ll see money in your pocket more quickly. Enterprise automatically updates and sends payments directly to the bank, so you’ll always know what your bottom line is. When your inventory is under control, you can rest easy and focus on the rest of your business.

QuickBooks Online Plans Comparison: 2023 Pricing & Subscription Levels

Their mobile app for iOS and Android devices ensures you get all the essential capabilities that QuickBooks Online provides. For one thing, it limits the number of invoices its customers can send each month to 20 with the cheapest plan. The lowest-tier plan users are also limited to managing just five bills a month and creating 20 estimates a month.

However, it removes the limitations on the number of classes, locations, and chart of accounts, making it ideal for businesses with a growing staff. QuickBooks offers a free one-on-one meeting with a QuickBooks ProAdvisor for new users. Your ProAdvisor will help you set up your company file, including adding your business information, setting up accounts, and connecting your bank accounts. QuickBooks has partnered with payment processors like PayPal, Stripe and Square.

If you are self-employed and report income on Schedule C of your personal income tax return, the QuickBooks Self-Employed plan will likely make the most sense. Manage multiple businesses with one login with Quickbooks multi-files. Run multiple accounts with one login, one password, and at a discounted rate. QuickBooks Online pricing does not include all the 750+ apps, third-party tools, and other bonuses that you can benefit from. However, it does provide the base for you to access them without integration hassles.

7 Benefits of Payroll Automation Automated Payroll

The same technology can be used for payroll teams that may traditionally work off of a shared Outlook Inbox. Upgrading from an existing payroll system to a new modern one might be the best-case scenario for your organization. However, it may not currently be the right time due to business conditions or other challenges. Luckily, Payroll Process Automation is in Reach for Companies of All Budgets. The second drawback is the need for your team and employees to adapt to a new system and processes.

With so many bells and whistles, it easy to understand why payroll automation is so beneficial. Similarly, such timekeeping features allow management to track, audit, and report on how many hours their workforces are putting in. Leadership can review and make decisions based on such data faster than ever before.

Allows for a smaller payroll team

This is especially true when regular salary changes are the norm, in sales or other commission-based environments. A digital worker will calculate these changes for you, managing salary budgets and updating records, taking the time and effort out of the review cycle. Research from both EY and Deloitte found that the average timescale for ROI was less than a year. It also benefits from comparably low operating expense (OPEX) costs.

This could be from improved efficiency; RPA will simply complete the process much faster. Or perhaps it’s from cutting down on the expensive and disruptive errors that tend to be a natural part of the payroll process. RPA can even help deliver value in other areas of HR, as payroll professionals are freed up to work on alternative projects and achieve their full potential. AIMultiple informs hundreds of thousands of businesses (as per similarWeb) including 60% of Fortune 500 every month. You can see more reputable companies and media that referenced AIMultiple. Throughout his career, Cem served as a tech consultant, tech buyer and tech entrepreneur.

The right technology can help your business avoid costly payroll miscalculations and penalties. So, in honor of hardworking payroll professionals everywhere, let’s examine a few core principles for achieving greater success (and less stress) by selecting the right payroll solution for your business. Automation helps companies organize all payment information, carry out payroll accurately and on time, calculate tax withholdings, and file taxes — all while staying compliant.

- You can do this much as you would for a new starter–a simple step-by-step guide to each element of the process, including any necessary yes/no decisions.

- Through payroll software, businesses can conveniently issue paychecks either electronically or by mail.

- Payroll is a necessary part of running a business to ensure your employees get paid accurately and on time.

- If your payroll involves intricate calculations, such as varying pay rates, complex tax structures, or multiple deductions, automation can be particularly beneficial.

- It serves as an advantageous choice for businesses of all sizes, particularly those searching for an affordable payroll solution accompanied by reliable customer support.

With its user-friendly interface and array of powerful features, it becomes an essential tool for any organization looking to optimize their payroll management processes. Once you have provided the necessary data to your payroll automation software, the software will be able to calculate employee wages, withholding taxes, issue paychecks, and file payroll tax reports. This can save you a significant amount of time and effort, and it can help to ensure that your payroll process is accurate and compliant.

Talent Management Strategy: In-depth Guide in 2023

In fact, errors in payroll can be costly for businesses, leading to fines, penalties, employee distrust, and even legal issues. Here are the three most common types of payroll errors and their causes. Deel’s automated payroll systems already have tax rates and rules embedded in their code. We automatically make wage deductions such as employment tax and employee benefits. According to the American Payroll Association, your costs might decrease by 80%. You don’t need to hire and pay in-house payroll managers and finance specialists if you have an automated solution like Deel–a small business owner, for example, can run payroll in minutes.

When it comes to payroll, Wave’s key value proposition is that you can manage payments, deductions, and taxes for both employees and contractors in one user-friendly platform. To do so, you must not only Payroll automation take into account your employees’ earnings but also their benefits, withholdings, and taxes. Using an automated payroll system means funds will be automatically transferred into the payroll account.

- Deel’s automated payroll systems already have tax rates and rules embedded in their code.

- With an automated payroll software, you don’t have to hire a large team of payroll professionals to oversee paying employees.

- By automating payroll processes, businesses can eliminate the need for manual data entry and calculations, which are not only time-consuming but also prone to errors.

Deel offers a payroll card for contractors that enables you to spend your money directly from your Deel balance. You can choose between the virtual card, used for online purchases only, or order a physical card that you can use for physical and online purchases. Deel’s automation reduces the chance of an HR employee making mistakes during calculation—after all, computers don’t get tired or forget to carry the one. In essence, this automation can use an HTTP webhook to send the employee a text message (which is customizable) once their payroll information is changed in the HRIS. Still, any oddball processes that your new solution can’t handle will need to be accounted for some other way.

Save Time and Money

Online payroll also means you can keep all paperwork in electronic form instead of hard copies. Hard copies take up physical space in your office and can easily get misplaced or damaged. That might be an issue since you must keep each tax form for a specific amount of time. Your company should already use a secure cloud storage platform to manage its records and back up the immense volumes of data it produces every day.

After deciding on a software solution, the organization can then proceed to feed their data into the system, train employees on how to use the new system, and implement its new automated payroll processes. Payroll management refers to the administrative task of calculating and managing employee salaries, wages, and benefits to ensure timely payments in line with local and international regulations. Traditionally, enterprises designate payroll clerks or a team of payroll specialists led by a payroll manager to execute such tasks. Also, HR or finance/accounting teams carry the responsibility of payroll management in many enterprises. You’ll understand what automated payroll is, why it’s the new standard for most businesses regardless of their number of employees, and how Deel’s payroll software solution can help. The six payroll automation softwares mentioned in this article offer a variety of features and benefits, so businesses of all sizes can find a solution that meets their needs.

Growing companies should give top priority to automated payroll solutions due to their valuable benefits demonstrated above. In the dynamic Indian business landscape, payroll management demands accuracy, compliance, and timeliness. Traditional methods of manually processing payroll can be error-prone, leading to discrepancies, employee dissatisfaction, and potential legal issues. A robust payroll software in India that is specifically designed for the Indian market is crucial for ensuring smooth payroll operations and overall business efficiency.

Wondering if you should automate payroll, and how to make it work for your startup? Not as readily obvious is the benefit of increased security that payroll automation provides. Employee information no longer needs to be shared across email or printed files where all sorts of accidental and intentional security risks are present.

Many of these fixes have since been converted into payroll modernization projects. As it stands, 61% of respondents to the Alight 2021 Global Payroll Complexity Index, published in October 2021, have outsourced some or all their payroll operations. Key drivers for this were regulatory complexity (42%), corporate strategy for outsourcing (30%), cost reduction (27%), and to support mergers and acquisition (M&A) activities (15%). For the first time ever, the use of agile cloud payroll technologies exceeds that of on-premise (62%)—a rise from 34.8% in 2019. Part of running payroll is writing checks and calculating different types of payment. All of this is time consuming to do by hand, but not with an automated payroll system.

Simply put, a payroll system is used by employers to pay their employees. Likewise, an automated payroll system allows an employer to process its payroll using an online system. Payroll is not an easy task, and your company may be struggling with it, but you don’t have to. When running a business, you need all the help you can get, and that’s what an automated payroll system can provide. Besides payroll, it also allows you to manage employee benefits, recruitment, training, and more.

How Payroll Software Can Revolutionize Payroll Management

For example, once an employee leaves, you can, from a platform like Slack, post a comment in the former employee’s HRIS profile, alerting your colleagues that they’re no longer part of the company. The colleagues you mention could then receive a message via chat in real time that alerts them of the comment; this can empower them to work quickly in removing the former employee from your payroll. To highlight how a payroll automation process can look, we’ll walk through a few examples.

With an automated payroll system, employees can view their pay stubs, update their direct deposit, and view deductions. Modern payroll automation software helps alleviate this mountain of responsibility by streamlining payroll processes that otherwise would take hundreds of hours for your staff to manually complete. Much like the earlier point on productivity, an RPA bot will complete payroll tasks much faster using fewer resources than the equivalent manual processes. For single tasks, such as salary processing, this can be invaluable. But when RPA is rolled out across several payroll software processes, it can deliver dramatic efficiency improvements for your business. If you’re a small business that can’t afford to bring on a full-fledged finance team, payroll automation means you can work with a smaller team, which allows you to save money by not paying more employees.

With the right automated payroll solution, you should have no trouble integrating your contractor payments with your employee payroll. Additionally, you can do so while remaining in compliance with all applicable tax and labor laws. Gusto is a cloud-based payroll automation software offering an extensive range of features, including time tracking, benefits administration, and HR management. Rippling stands as a cloud-based payroll automation software, offering a diverse range of features including time tracking, benefits administration, and HR management. It’s impossible for one or several individuals to keep track of the many changes coming out of federal, state and local taxing jurisdictions.

What Is Selling, General & Administrative Expense SG&A? How to Calculate & Examples

Content

- Excessive SG&A Spending

- Owl Bookkeeping & CFO Services

- What is Selling, General and Administrative Expense?

- What’s the difference between SG&A vs. operating expenses?

- Understanding SG&A: Selling, General, Administrative Expenses – Definition and Explanation- FAQs

- All about expenses: Selling, General & Administrative (SG&A)

- Strategies for Improving Efficiency and Effectiveness in SG&A Spending

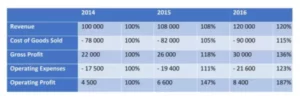

If a business owner fails to grasp that, a company may be stuck with its financial problems for quite some time. On the contrary, tracking the right combination of financial KPIs may prove effective for making data-driven decisions and as a result building a successful and modern business. For example, when a unit is sold, there may be packaging and shipping costs and sales commission payable to the salesperson. The most common examples are rent, insurance, utilities, supplies, and expenses related to company management, such as salaries of executives, admin staff, and non-salespeople. Certain companies will file their financial statements with one line for SG&A, while others – for example, software companies – will separately break out G&A and sales & marketing. Once SG&A is deducted from gross profit – assuming there are no other operating expenses – operating income (EBIT) remains.

The more detail the figures you have at your fingertips and the more insight you gain into them, the better you can manage your company’s finances. From this you subtract the cost of goods sold (CGS) which might be, say $30,000. It’s useful to know which categories within this broad heading of business expenses your various outgoings fall. You’ll want to be clear on the costs of salaries and commissions as these might well be your largest expenses here. In this sample income statement, you can see how SG&A expenses are deducted from revenues along with other expenses to yield profit.

Excessive SG&A Spending

Calculate the Selling, General, and Administrative expenses (SG&A) by adding all the expenses incurred by a company in its daily operations, excluding the costs of producing goods or services. You do this by adding the costs of selling, general, and administrative expenses. General expenses, or overhead Sg&a Expense Selling expenses, are a subset of Selling, General, and Administrative (SG&A) expenses. They refer to the costs incurred by a company in its daily operations, not directly tied to producing goods or services. A company incurs these expenses to support its operations, regardless of whether it generates sales.

- However, it is important to establish clear guidelines and communication channels to ensure that remote workers remain connected and engaged with the rest of the team.

- Accurate, bank-ready financials allow you to make better decisions for your company.

- However, it is important to note that the classification of certain costs might depend on the specific context and industry.

- On occasion, it may also include depreciation expense, depending on what it’s related to.

- Aside from monkeying with the books, there are only three possible fixes for low profitability.

- Interest expense and research and development costs are calculated separately from SG&A.

With Profit Frog, business owners don’t need to stress about calculating costs. We give you a clear view of what’s going on in your business and where you can increase profitability. The items that didn’t get sold in the previous year become part of the beginning inventory for the upcoming year. If the business makes or purchases additional products, they will be added to the inventory. Generally accepted accounting principles (GAAP) defines COGS as the general cost of producing items sold during a selected period. When you leave a comment on this article, please note that if approved, it will be publicly available and visible at the bottom of the article on this blog.

Owl Bookkeeping & CFO Services

Cutting operating expenses can be less damaging to the core business. SG&A costs are typically reduced after a company merger or acquisition makes it possible to reduce redundancies. Communication breakdowns can also lead to duplication of work and unnecessary expenses. By avoiding these mistakes, businesses can better manage their https://kelleysbookkeeping.com/ SG&A expenses and improve their financial performance. It is important to note that while SG&A expenses are necessary for the day-to-day operations of a business, they can also be a significant burden on profitability. To calculate the SG&A expense ratio, businesses must first determine which expenses fall under the SG&A category.

- Indirect selling expenses are incurred either before or after the sale is made, and examples include salaries, benefits, and wages for salespeople, travel, and accommodation expenses.

- SG&A expenses are simple to calculate once you’ve classified them into the correct categories.

- Please do not copy, reproduce, modify, distribute or disburse without express consent from Sage.

- Even though Excel is more familiar for most people, this procedure is way simpler when using accounting software which automatically categorizes expenses based on the initial setup.

There are also a few specific accounts that may warrant specific accounting treatment that exclude them from SG&A. For example, research and development costs are often not to be included in SG&A. In addition, depreciation costs are often reported in this section of the income statement but excluded from SG&A as well. Finally, businesses may overlook the importance of employee training and education when it comes to managing SG&A expenses. Employees who are not properly trained on expense tracking and management may make mistakes or miss opportunities to save money. By investing in employee education and training, businesses can ensure that everyone is on the same page and working towards the same goals.

What is Selling, General and Administrative Expense?

Tracking SaaS COGS accurately is important for accounting and modeling. Our SaaS business forecasting software includes a handy cost of goods sold calculator to make COGS—and all other aspects of budgeting and forecasting—much easier. Profit Frog is the leading financial planning and analysis (FP&A) software specifically designed to aid small businesses. We simplify COGS calculations and make them actionable so you can improve profitability. GEP SMART is an AI-powered, cloud-native source-to-pay platform for direct and indirect procurement. Having timely, accurate information about your income and costs is essential.

One of the first things that a company does to increase profitability is cut operating expenses. Cutting the base salary of non-sales personnel is a quick way to reduce costs without interrupting manufacturing or sales. Indirect selling expenses are incurred during the manufacturing process and after the product is finished. Marketing, advertising and promotion expenses, including social media costs are a good example of indirect selling expenses.

What’s the difference between SG&A vs. operating expenses?

Base salaries of salespeople and travel expenses refer to this category as well, even if they don’t generate income. SG&A includes most other costs related to running a business aside from COGS. These costs are not related to specific products, so they are categorized separately from the cost of goods sold (COGS) on the income statement. SG&A expenses are sometimes referred to as period costs since they relate to the time period in which they are incurred, and they do not relate directly to production.

Accounting Journal Entries: Definition, How-to, and Examples Bench Accounting

Then, credit all of your expenses out of your expense accounts. For the sake of this example, that consists only of accounts payable. Every transaction your business makes requires journal entries.

To record depreciation expense, debit depreciation expense, and credit the accumulated depreciation account. In order to pay for an expense on credit, the related expense or asset account will be debited, and the payable account will be credited. Keeping track of all of your business transactions shows you how cash flows in and out of your company. Here’s one example of preparing a journal entry for your payroll expenses. Businesses that follow Generally Accepted Accounting Principles (GAAP) must use the accrual accounting method, which means that you record expenses and revenue on the day they are incurred.

Examples of Journal Entries in Accounting

If you’ve paid for the expense, you’ll credit your cash account, and if you still owe the money, you’ll credit accounts payable or accrued expenses. Depreciation is an accounting tool businesses use to record the loss in value of physical assets (like vehicles or machinery) over time. It’s recorded on financial reporting documents, like balance sheets and income statements. You credit your cash account to record money leaving the business if you’ve paid for the expense.

Using our vehicle example above, you must identify what transaction took place. This means a new asset must be added to the accounting equation. Crediting an asset account decreases the balance, while crediting a liability or equity account increases it.

What Is the Difference Between Cash Accounting and Accrual Accounting?

We now return to our company example of Printing Plus, Lynn Sanders’ printing service company. We will analyze and record each of the transactions for her business and discuss how this impacts the financial statements. Some of the listed transactions have been ones we have seen throughout this chapter.

When you use accounting software, the above steps still apply, but the accounting software handles the details behind the scenes. Deferrals refer to revenues and expenses that have been received or paid in advance, respectively, and have been recorded, but have not yet been earned or used. Unearned revenue, for instance, accounts for https://kelleysbookkeeping.com/cpa-accounting-taxation-bookkeeping-outsourcing/ money received for goods not yet delivered. The purpose of adjusting entries is to convert cash transactions into the accrual accounting method. Accrual accounting is based on the revenue recognition principle that seeks to recognize revenue in the period in which it was earned, rather than the period in which cash is received.

Examples of Journal Entries with a PDF

Purchase Returns are the goods returned by the company to the seller or creditors. Drawings are goods or cash withdrawn by a proprietor for their personal use from the business. In this case, the proprietor may be charged interest at a fixed rate. Generally, 8 Best Accounting Software for the Self-Employed in 2023 interest on capital is an appropriation of profit, which means in case of loss, no interest is to be provided. Hence, debit the Profit and loss appropriation A/C and credit Interest on capital A/C at the time of transferring Interest on Capital.

- It is usually expected that you leave some space at the left-hand margin before writing the credit part of the journal entry.

- It has all original transactions recorded in it, in chronological order.

- The amount that was prepaid (rent for February through June) gets recorded as an asset in a prepaid rent account.

- Observe the list of transactions, and then try recording a journal entry for each.

- In the journal entry, Dividends has a debit balance of $100.

Ongoing Sriracha Shortage Causing Amazon Vendors to Sell One Bottle for $23

All the methods and tools you use to conduct vendor arrangements and relationships comprise vendor management. Instantly, compare your best https://online-accounting.net/ financial options based on your unique business data. Know what business financing you can qualify for before you apply, with Nav.

With that extra time to pay, he could often complete a job and invoice his clients without laying out money for the supplies up front. “It was a great way to float costs between customer payments,” he says. Many net 30 vendors then report the what is equity method of accounting on-time payment to the credit bureaus. A net 30 account is a credit term used in business-to-business transactions, wherein the buyer is allowed 30 days from the invoice date to pay the seller in full for the goods or services received.

Different Types of Vendors

A net 30 term often offers discounts to businesses that pay their invoices in full within a shorter period of time than 30 days. Wise’s approval process requires you to be in business for 30 days as well as have an Employer Identification Number (EIN), a DUNS number, and no recent derogatory marks on your business credit reports. Wise Business Plans provides business owners with business planning resources and tools.

- These accounts are often easier to qualify for than small business loans because limits are lower (at least to start) and suppliers want your business.

- There will be a business credit check and you must have a clean business credit history with no late payments reported in the last 6 months.

- A wider use of the term vendor would be the peanut vendor at a baseball game or the vending machine in the break room.

- And that interest may outweigh the discount you received, so be sure to set up a system to pay on time.

- Net-30 terms means full payment is due 30 days after the invoice date.

Plans cover a variety of purposes, including franchises, non-profits, as well as investor grade and bank compliant plans. Each business plan is custom written by writers with MBAs, researchers, and financial modelers, and are professionally designed. To open a net 30 account, a business must be a US business, have 90 in business at least, and business info such as EIN, type of business, a registered business number, or DUNS etc. Once you’ve found a net 30 vendor you like, you’ll need to fill out an application form and submit it along with whatever fee is required. Our Net 30 Vendors to Build Business Credit list will help you choose the best net 30 accounts for your small business.

How Vendor Management Requirements Differ among Different Types of Organizations

The sweet spot for ULINE to start reporting your payment history is usually around $75 and $100, and they’re a strong company to have on your business credit profile. Once you’ve established a business credit file, make sure you are doing your part to build your credit history by paying on time. Most small business card issuers report to at least one commercial credit reporting agency. A service called eCredable Business Lift will verify and report accounts to multiple business credit bureaus for a small fee. Even better, it will report the most recent payment history up to 24 months. As this chart explains, most business credit cards report to at least one of the business credit bureaus and most report to multiple bureaus.

- With these types of financing you may be able to repay debt over a period of months or years.

- Veriti reduces the risk of breaches by enabling faster remediation of gaps in the security posture.

- Shirtsy also does print-on-demand T-shirts and other branding collaterals like business cards, etc.

- As you establish a track record of on-time payments you can ask for a higher credit limit.

- Also, keep in mind that not every vendor reports to all the major business credit bureaus.

Business owners use this capital to grow their companies quickly. When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. In addition to looking for quality, pricing controls, and consistency in delivery, strategic vendor managers explore opportunities for innovation, cross-planning, and new partnerships. As with any type of business financing there are pros and cons.

Easy Approval Net-30 Accounts To Build Business Credit

A vendor that supplies one of these large stores would need a much larger operation to plan for, acquire, and provide the goods and services they are contracted for. The Divvy credit builder provides easy credit access for your growing business, builds your credit, and gives you access to some of the industry’s best technology for expense management. Best practices in vendor management maximize opportunity and value from your vendor partnerships. Use proven approaches to select and supervise vendors, deliver a higher-quality service or product, lower risk over the life of your contract, and continuously improve performance.

You can get net 30 terms for some services and all of their store items. Doing so will ensure all of your payments report to your credit and strengthen your business credit profile, thus, increasing your likelihood to receive more financing down the line. Of course if you don’t pay your balance in full, you’ll be charged interest at the credit card’s purchase interest rate. And that interest may outweigh the discount you received, so be sure to set up a system to pay on time. Longer payment terms gives the entrepreneur longer to pay the amount due, and in that regard it can be helpful for cash flow.

It can sell services, products, or a combination of the two to businesses and consumers. Some large retail store chains, such as Target and Walmart, generally have a list of vendors from which they purchase goods at wholesale prices. In turn, they then sell the goods at retail prices to their customers.

Peak Performance Guide to Vendor Management

If payment is not made within the 30-day period, the seller may charge interest or late fees. “Net 30” refers to the net amount of time that a business has to pay for an invoice or other payment before they are subject to late fees. This term is typically used in industries where payments are expected on a monthly basis, but some businesses may extend this concept to be any percentage of the time, such as 60 days or 90 days. Net 30 terms are a “buy now, pay later” arrangement giving businesses 30 days to pay off an invoice for products they’ve already received.

Supplier Privacy Notice – GroupM

Supplier Privacy Notice.

Posted: Wed, 06 Sep 2023 05:45:17 GMT [source]

To check your business credit score you’ll need to contact the business credit bureau for the score you wish to check. For example, Dun & Bradstreet’s PAYDEX score is from 1-100, where one is the worst score and 100 is the best. Creative Analytics offers digital marketing services and tech products.

The CEO Creative meets a variety of business needs in one stop. They offer office supplies, custom website design and branding services, business accessories, electronics and custom apparel. There will be a business credit check and you must have a clean business credit history with no late payments reported in the last 6 months. Your business can be quickly approved for a starting credit limit of up to $3,500 with no personal credit check or personal guarantee. Net-30 accounts are accounts that extend you 30 days to pay the bill in full after you have purchased products.

An EIN is required, and terms and conditions state a business entity is required. Like other credit forms, vendor credit accounts help you establish credit when you make on-time payments. Vendor accounts are my preferred method to jump-start your business’s financial strength because they generally do not require you to provide personal guarantees. Generally, at the earlier stages of building business credit, you’ll usually receive 30-day repayment terms (Net 30). As you begin to accumulate more of a payment history among all vendors, the repayment terms can be negotiated for more extended periods – 60 days, and on.

Setting up an account with Quill is quick and easy, and you’ll be able to start building a business credit profile with a minimum spend of $50. If you already have existing vendor accounts that are set up with net 30 payment terms, you can also ask suppliers if they’re willing to increase those to net 45 or net 60 terms. You might be able to secure lengthier payment terms and transform your net 30 accounts into net 60 accounts simply by asking. Each vendor account listed here offers a wide variety of products that many businesses can use. By purchasing items you need for your business on payment terms and then paying on time, you may build a positive business credit references.

Even if you already have a vendor management program in place, key aspects of that program must function at a high level. So, make sure the company supports your program as a strategic function from the top down. Quigley uses his process steps to manage vendors and their projects that deliver products and services. He has applied these principles to large, international clients in the aerospace, automotive, and manufacturing industries. To manage and collaborate with vendors, companies use strategies and tactics known as the vendor management process.

Invoice Financing vs Invoice Factoring: Whats the Difference?

Content

But this type of financing can get expensive, especially if the financing company raises fees the longer a client doesn’t pay. Once your client pays the invoice, you’ll pay the lender back the amount loaned plus fees and interest. With https://www.bookstime.com/articles/remote-bookkeeping, your business is still responsible for collecting outstanding money owed by your clients. The good news is that invoice financing is available to small business owners who have a less-than-perfect credit score. The most important thing is the creditworthiness of your customers. That can make it a viable option for businesses that may not be able to access a bank loan.

Because your invoices serve as collateral, invoice financing can be easier to qualify for than other small-business loans, although borrowing costs can be higher. You still own the unpaid invoices and remain responsible for collecting payment on them. With invoice discounting, the lender will advance the business up to 95% of the invoice amount. When clients pay their invoices, the business repays the lender, minus a fee or interest. Invoice financing can be structured in a number of ways, most commonly via factoring or discounting.

Business line of credit

Invoice financing is usually offered by online lenders and fintech companies. Compared to other types of business loans, banks are less likely to provide invoice financing. Business lines of credit are flexible financial arrangements that allow businesses to access a predetermined amount of money from a lender. Unlike traditional loans, where a lump sum is provided upfront, a business line of credit lets the borrower withdraw funds as needed, up to the approved limit. One of the main advantages of bank loans is that they provide access to a substantial amount of money that can be repaid in manageable installments.

- With no minimum credit score requirement, find the perfect funding solution for your needs.

- Invoice financing is usually a better option for businesses that want to maintain control over invoices and deal with their customers directly.

- This means that invoice financing is less risky for lenders, as compared to other types of financing such as an unsecured line of credit.

- Our experts have been helping you master your money for over four decades.

- The sooner customers pay, the less you’ll pay in fees; the longer they take to pay, the more you’ll pay in fees.

- Like invoice financing, a business line of credit can supply your company with immediate working capital.

- But if you qualify for other types of financing, you should explore those since borrowing costs are likely to be lower with other options.

In other words, you may have to repay the money you received from the factor. Before entering into an invoice factoring agreement, thoroughly research and compare different factoring companies. If you have an existing trusted relationship with a lender or payment processor, ask if they have early payment options. Invoice factoring is beneficial for businesses experiencing cash flow challenges. Misuse of business credit cards can lead to high-interest debt, affecting a company’s financial health. Additionally, interest rates can be relatively high, and some cards come with annual fees.

Invoice Discounting Example

Here are the steps to apply for invoice financing through United Capital Source. Merchant Maverick’s ratings are editorial in nature, and are not aggregated from user reviews. Each staff reviewer at Merchant Maverick is a subject matter expert with experience researching, testing, and evaluating small business software and services. The rating of this company or service is based on the author’s expert opinion and analysis of the product, and assessed and seconded by another subject matter expert on staff before publication.

Keep reading to learn about the differences between invoice factoring and invoice financing to see which one makes the most sense for your business. The terms “invoice financing” and “invoice factoring” are often used synonymously, though they’re not the same thing. In these instances, many small business owners will hop on the chance to secure a loan.

Invoice Financing with Velotrade

Your ability to repay the loan depends on your customers paying their invoices. Make sure that you and the invoice financing company can trust they will pay. Getting approved for accounts receivable financing is much easier than other business financing programs. In fact, one of the main reasons businesses pursue invoice financing is that they couldn’t qualify for a less expensive alternative. With accounts receivable financing, you receive a cash advance using your invoices as collateral.

Your invoice serves as collateral, which makes you a less risky borrower to a potential lender. Invoice financing can help business owners account for gaps in cash flow in order to purchase inventory, pay employees and, ultimately, grow faster. Business credit cards offer several benefits, including ease of use, flexibility and the potential to earn rewards or cashback on eligible purchases.

Top Startup Funding Options: Grow Your New Business

Content

These bonuses are added each time you perform a Skill or Action related to that Ability. So, the higher your Ability Score, the higher the bonus you’ll get, leaving your success less reliant on the luck of the die. Once you’ve set up the right track types and project settings in Logic Pro, it’s time to select your sounds and start recording. Edit your audio and MIDI regions in their editor windows, and use effects in the Channel Strip Inspectors. Then, experiment with automation and Flex Modes, and you’re well on your way to creating high-quality productions.

Be fully transparent with them about the risks so your relationships withstand any bumps along the road. If things don’t plan out as hoped, at least you were upfront and honest from the beginning. Do you have a great startup idea but don’t know how to get the money to make it happen?

Types of Startup Funding for Business

People won’t start throwing money at you just because you have a business idea. If you’re an entrepreneur, the first thing you can expect is funding from your side. See, we are not telling you to fund in millions, but to help you get by.

Please complete only the section(s) of the Form C-100 to be amended, along with the form’s execution page. All changes to the organization’s registration statement must be verified and signed by an authorized executive officer of the organization. If the United States Internal Revenue Service determined that the organization is tax exempt, submit a copy of determination letter.

Bank Loan

Another worthwhile technique is to Ctrl + click on a Track Header and hover over Track Header Components. These two options will appear in the Track Header and let you activate/deactivate tracks and freeze them in place How to Get Funding for a Startup A Beginners Guide which reduces the load on your CPU. As your projects increase in size, this becomes increasingly important. However, the following provides an overview for learning each of the steps along the way to becoming a charity.

There are a few different ways to go about securing funding for your startup. The first is to bootstrap your business, which means to self-fund your business using your own savings or personal loans. This is the most common method of funding a startup, as it doesn’t require giving https://quickbooks-payroll.org/ up equity in your company or taking on debt. These are typically awarded to companies working on innovative or socially beneficial projects. Government grants can be a great way to get funding for your startup, but they are often very competitive and can be difficult to obtain.

Charitable Organization Expiration / Reinstatement

This process can take some time, so be patient and make sure all the paperwork is in order before signing anything. Investing in a startup business is a big decision, so you need to make sure you do your homework before making any commitments. This means researching the business, the team, and the industry before making any decisions. Your network is a valuable resource when it comes to finding potential investors.

- The idea is to add keywords to your listing that people search for, and adding irrelevant keywords can hinder your visibility.

- Use Foundercrate as a fundraising process management and investor relationship management tool.

- But you can also find them directly through their websites or via startup events.

- Series B investors again tend to receive preferred stock in return for their capital investment.

- A traditional business loan can be difficult to get as a startup, but the SBA offers microloans and other loan programs specifically designed for new businesses.

Many investors won’t treat you seriously if you don’t manage to convince people close to you that your business idea is sound. It is quite rational because getting your relatives and friends on board is one of the easiest and most popular ways to get funding for your startup. If you’re not sure where to start, there are plenty of resources available to help you develop your business plan.

Understanding the Basics of Annuity Accounting

Insurance companies sell annuities, as do some banks, brokerage firms, and mutual fund companies. Your most important source of information about investment options within a variable annuity is the mutual fund prospectus. Request prospectuses for all the mutual fund options you might want to select. Read the prospectuses carefully before you decide how to allocate your purchase payments among the investment options.

There’s a reason why many people who look into an annuity stop dead in their tracks and run the other way before signing on the dotted line. Market chaos, inflation, your future—work with a pro to navigate this stuff. In reality, annuities are super complicated and come in several different shapes and sizes. When you buy an annuity, you’re gambling that you’ll live long enough to get your money’s worth—or, ideally, more than that. Annuities often have high fees, so shop around and make sure you understand all of the expenses before purchasing one.

The term “annuity” refers to an insurance contract issued and distributed by financial institutions with the intention of paying out invested funds in a fixed income stream in the future. Investors invest in or purchase annuities with monthly premiums or lump-sum payments. The holding institution issues a stream of payments in the future for a specified period of time or for the remainder of the annuitant’s life. Annuities are mainly used for retirement purposes and help individuals address the risk of outliving their savings. Unlike with a more common fixed annuity, a variable annuity lets you invest in subaccounts like mutual funds while delaying taxes on your gains. When ready, you can turn your investment balance into future income payments.

AM Best Affirms Credit Ratings of Teachers Insurance and Annuity … – Business Wire

AM Best Affirms Credit Ratings of Teachers Insurance and Annuity ….

Posted: Thu, 27 Jul 2023 13:13:00 GMT [source]

It’s more important to establish an emergency fund, max out employer 401(k) contributions and reduce high-interest debt before considering tying up your cash into this kind of investment. Other riders may be purchased to add a death benefit to the agreement or to accelerate payouts if the annuity holder is diagnosed with a terminal illness. The cost of living rider is another common rider that will adjust the annual base cash flows for inflation based on changes in the consumer price index (CPI). You can choose to receive payments for a specific period of time, such as 25 years, or for the rest of your life. Of course, securing a lifetime of payments can lower the amount of each check, but it helps ensure that you don’t outlive your assets, which is one of the main selling points of annuities. You may be charged a penalty if you take your money out early, if you’re not yet 59½ (additional 10% tax penalty), or both.

Chip Stapleton: Strategies To Get the Most Out of Annuities in Your Retirement Plan

Unfortunately, most people don’t win it big, but an extremely small percentage of people do. After they win, they often have to make the choice whether to be paid in a lump sum or in an annuity. For example, a million dollar jackpot could be paid out immediately in one lump sum of $600,000 or in $5,000 monthly installments for 15 years. Most investment and loans are set up as annuities to keep the terms simple. “Thereafter,” the IRS warns, “your annuity payments are fully taxable.”

When you reach your payout period, you’ll likely begin receiving monthly payments as you would from a pension or a paycheck during working years. Any interest earned on a deferred annuity won’t be taxed until you make a withdrawal. The time during which your investment earns interest is known as the accumulation phase. The time during which you receive payments is known as the annuitization phase. Depending on the type of annuity you are investing in, your annuitization phase may begin immediately. As such, these financial products are appropriate for investors, who are referred to as annuitants, who want stable, guaranteed retirement income.

Annuity education

Setting up an annuity with lifetime payments can help insulate you from the ups and downs of the market, and provide a predictable stream of income. An annuity is an insurance contract that exchanges present contributions for future income payments. Sold by financial services companies, annuities can health care fsa limit projected to remain the same for 2021 help reinforce your plan for retirement. Annuity contracts, however, have widely varying terms, and some charge high costs. If you’ve ever wondered what is an annuity, our guide will help you understand the key details so you can decide whether an annuity might be right for your retirement plan.

Life and annuity products are issued by Nationwide Life Insurance Company or Nationwide Life and Annuity Insurance Company, Columbus, Ohio. The general distributor for variable products is Nationwide Investment Services Corporation (NISC), member FINRA, Columbus, Ohio. Nationwide Funds are distributed by Nationwide Fund Distributors, LLC, Member FINRA, Columbus, OH. Nationwide Life Insurance Company, Nationwide Life and Annuity Company, Nationwide Investment Services Corporation and Nationwide Fund Distributors are separate but affiliated companies.

A Guide to Selling Your Structured Settlement Payments

At Nationwide, we offer you education, resources and secure online access to your annuity, so you’re able to make informed decisions with your financial professional. Our tools let you see and explore what the variety of annuities available through Fidelity could do for you and your investment goals. If you’re interested in buying an annuity, a representative will provide you with a free, no-obligation quote. Click here to sign up for our newsletter to learn more about financial literacy, investing and important consumer financial news.

A fundamental difference between annuities and bonds is that annuity contracts are somewhat negotiable, while the terms of bonds are not. You can add benefits or modify terms before you finalize an annuity contract, but a bond indenture cannot be changed. Many retirees need more than Social SecuritySocial SecuritySocial Security is a federal benefits program for retirees in the United States, funded by taxes. Annuities provide individuals with a way to potentially accumulate wealth, defer taxes, preserve their principal and ensure a reliable income stream in retirement. Once the initial guarantee period in the contract expires, the insurer can adjust the rate based on a stated formula or on the yield it is earning on its investment portfolio. As a measure of protection against declining interest rates, fixed annuity contracts typically include a minimum rate guarantee.

How Does Ordinary Annuity Differ From Annuity Due?

Our expert reviewers hold advanced degrees and certifications and have years of experience with personal finances, retirement planning and investments. Whether you want to kick-start their retirement savings or get them through college debt-free, here are some ways you can invest in your child’s future. There are a few things you need to understand about annuities before you commit. To live the life you want to lead in retirement, start early, set goals and create an investing plan that will help you achieve those goals. The IRS says the expected return for the annuity is 20.0 times 12 times $100, or $24,000.

Most financial advisors recommend leaving these annuities untouched for a while and start receiving payments in your late 60s or early 70s. Like most long-term investment accounts, it’s generally a smart idea to leave them alone and allow them to generate as much interest as possible, making your payments higher when they begin. Immediate annuities are often purchased by people of any age who have received a large lump sum of money, such as a settlement or lottery win, and who prefer to exchange it for cash flows into the future. Deferred annuities are structured to grow on a tax-deferred basis and provide annuitants with guaranteed income that begins on a date they specify.

Life insurance companies and investment companies are the two primary types of financial institutions offering annuity products. For life insurance companies, annuities are a natural hedge for their insurance products. Life insurance is bought to deal with mortality risk, which is the risk of dying prematurely. Policyholders pay an annual premium to the insurance company that will pay out a lump sum upon their death. For example, an issuing insurance company sets the rateAnnuity RateThe rate of growth, expressed as a percentage, set by the insurance company at the start of the annuity contract term. Depending on the type of annuity, the insurance company may guarantee the interest rate for a year or longer, or the rate may fluctuate with a stock market index.

- Most annuities in America are purchased from distributors, brokerage firms, banks, mutual fund companies and independent agents.

- In return, they promise to grow your money and send you payments during retirement.

- In addition, inflation continues to pose a major risk to retirees in 2023, but annuities present a few solutions to this problem.

- Before you start withdrawals, this annuity offers a guaranteed growth rate for your future income.

- The cost of living rider is another common rider that will adjust the annual base cash flows for inflation based on changes in the consumer price index (CPI).

In addition, inflation continues to pose a major risk to retirees in 2023, but annuities present a few solutions to this problem. Speak with a licensed agent about top providers and how much you need to invest. Ramsey Solutions is a paid, non-client promoter of participating Pros. And unlike a 401(k) or an IRA, annuities don’t have yearly contribution limits, so you can put as much money into an annuity as you’d like.

Why Is Future Value (FV) Important to investors?

Annuities can be used for a variety of purposes, including as a source of retirement income, as a way to save for the future, or as a means of managing financial risk. It’s important to note that the discount rate used in the present value calculation is not the same as the interest rate that may be applied to the payments in the annuity. The discount rate reflects the time value of money, while the interest rate applied to the annuity payments reflects the cost of borrowing or the return earned on the investment. This will be true regardless of whether the insurance company earns a sufficient return on its own investments to support that rate. That’s one reason to make sure you’re dealing with a solid insurer that gets high grades from the major insurance company credit rating agencies. Insurance companies invest your initial payment, exposing that lump sum to the market and allowing it to increase over time.

At their most basic, annuities work by converting a premium into a stream of payments. The amount and duration of the payments depend on various factors, including the type of annuity, the premium amount, the annuitant’s age and the chosen payout option. Lincoln Financial’s Legacy Target Date variable annuity took our top spot for its low fees, starting at 0.10% per year, and a promised minimum income benefit regardless of your investment performance. Your return depends on how old you are when you buy and your target date for retirement. In most cases, the investments offered within a variable annuity are mutual funds.

Legal & General Says IFRS 17 Accounting Transition Doesn’t Change Strategy, Solvency or Dividends – MarketWatch

Legal & General Says IFRS 17 Accounting Transition Doesn’t Change Strategy, Solvency or Dividends.

Posted: Wed, 05 Jul 2023 07:00:00 GMT [source]

That initial investment grows tax-deferred throughout the accumulation phase, typically anywhere from five to 30 years based on the terms of your contract. Once the annuitization, or distribution, phase begins — again, based on the terms of your contract — you start receiving regular payments. Tax-deferred variable annuities are typically invested with nonqualified money, or money that does not already have a special tax treatment such as 401(k) or IRA money. An advantage of tax-deferred accounts is that you can defer paying taxes on investment earnings until withdrawn. The power of this deferral can be significant over time because your savings will have an opportunity to compound by realizing earnings on earnings.

Commissions typically range from 1% to 10% of the contract value and may come in the form of a one-time fee or as a recurring, “stream” commission structure. Sometimes people don’t think of them as annuities because they are not receiving the payments. Remember annuities are just agreements with equal payments and time intervals.

When a business signs a loan with a bank, it agrees to make a payment each month for specific amount. The payments are due each month until the loan principle is paid off. A variable annuity is a way to get the stability of a traditional annuity product with the gains of an investment account—for a price. Annuities are attractive to people who want a steady income stream when they retire. An annuity might also be an option for those further along in their investment journey or have received an inheritance. Insurance companies make it practically impossible to get to your money without paying an arm and leg.