How Much Does QuickBooks Cost?

Our internal case study compares the four QuickBooks Online versions across major accounting categories and functions to help you decide which one fits your needs. QuickBooks Self-Employed is not included in the case study because it is not a full double-entry bookkeeping system. If you are going to charge such exorbitant prices for your product, it better be perfect. Then, consider all the add-ons you get nickeled and dimed for and it’s hard to say it’s worth the cost. Services like Shopify, TSheets and MailChimp have integrated with QBO.

- The QuickBooks Online Simple plan costs $30/month and supports one user.

- Invoices can be sent manually or scheduled to be sent automatically on a recurring basis.

- QuickBooks calculates the sales tax rate based on date, location, type of product or service, and customer.

- There are no contracts, and all QuickBooks pricing plans can be tried out for a 30-day free trial, which is a great way to let potential customers see if it is the right option for them.

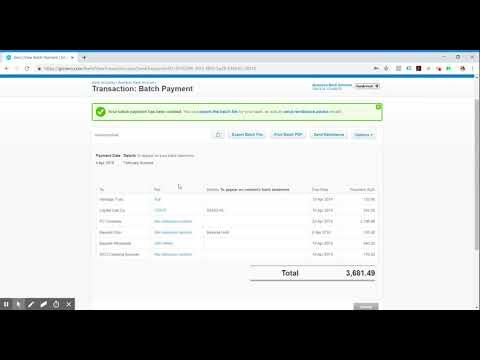

With QuickBooks Online, you can send, track and file 1099 forms for independent contractors. Automatic updating of 1099 forms ensures your company remains compliant with IRS requirements and provides your freelancers with the documentation they need to pay their taxes. Not nearly every accounting software platform we reviewed offers this functionality, and we saw its benefit for any business that hires freelancers immediately. QuickBooks Online Advanced is slightly better than Plus and the other QuickBooks Online plans in A/P and A/R because of its batch invoicing and expense management features. Batch invoicing allows you to create multiple invoices at once rather than creating them one at a time. This can be useful if you have many customers who need to be invoiced for the same products or services.

Standard checks begin at $46.26/per 50 checks; prices vary by check type and amount. Small-business owners who prefer to work on software that’s locally installed on their computers will appreciate the simplicity of QuickBooks Desktop Pro Plus. Users can switch plans or cancel without having to pay termination fees. Based on what you get in each plan tier, though, it is certainly competitive. Make sure that you know exactly what you need before you make a selection. Create customized tags and run reports to reveal the financial state of your business.

QuickBooks has an accounting tool specifically for freelancers called QuickBooks Online Self-Employed, which starts at $15 a month. QuickBooks Self-Employed tackles basic freelance bookkeeping features like expense tracking, receipt uploading, tax categorizing, quarterly tax estimating and mileage tracking. QuickBooks Online Simple Start is geared toward solopreneurs, sole proprietors, freelancers and other micro- and small-business owners. Its basic features include invoicing, online payment acceptance, 1099 contractor management and automatic sales channel syncing (for e-commerce business owners). With versions dedicated to contractor, manufacturing & wholesale, nonprofit, retail, and professional services, Enterprise is designed specifically for your industry. Industry editions provide specialized features, like customized chart of accounts and critical reports targeted to your type of business.

New Payroll Pricing

This service uses your existing QuickBooks Online accounting information to determine your eligibility for a loan. If you choose this funding option, there are no origination fees and no prepayment fees, but you will be expected to make weekly payments plus APR. Payments vary based on your loan amount, credit score, and term length. QuickBooks Online users can get access to QuickBook’s lending service — QuickBooks Capital. QuickBooks Capital is a working capital loan to help small business owners run their operations, whether that’s covering new hires, ordering inventory, making payroll, etc. In addition to the monthly subscription price, there are a few other QuickBooks Online charges to be aware of.

- There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

- A key added feature of the QuickBooks Essentials plan is the ability to manage unpaid bills and allocate billable time and expenses to a specific customer.

- The software includes at least 20 different pre-built report types, as well as custom reports in some plans.

QuickBooks offers more — and better — reports than nearly any other accounting software provider. With the Simple Start plan, QuickBooks’ software will generate cash flow statements, income Paid Telephone Bill Journal Entry statements and balance sheets. Users can also use it to create customized tags and reports that help you hone in on specific income and expense trends and up your business’s cash flow.

QuickBooks Online also integrates with third-party apps so you can connect the programs you already use. With automatic updates to your company’s ledger, the software enables you to invoice clients, view accounts receivable, and accept payments. Avoiding this costly error alone can justify QuickBooks Online pricing. To help you manage cash flow, QuickBooks enables you to track spending, profitability, and inventory. Your income and expenses are automatically tracked by the application, which also automatically categorizes them.

Advanced Pricing lets you control, customize, and automate your pricing, right from within QuickBooks. No more manual updates, so you can easily change your prices to keep that bottom line growing. You just set the price rules and Advanced Pricing will do the calculations.

QuickBooks Online Expert Services & Sales

Additionally, these discounts are only available if you skip the 30-day free trial. QuickBooks Online by Intuit is one of the top-rated and used bookkeeping and accounting software tools for all your financial management needs. It’s great if you want to work with a bookkeeper or accountant on a regular basis. This cloud-based solution means that there’s no installation required.

Contractors should also select Plus to track the profitability of individual projects. Other businesses should consider whether tracking P&L by class and location is worth the extra $30 per month. We are big supporters of cloud-based software—check out our post on Xero vs QuickBooks to see why.

Merchant Maverick’s ratings are editorial in nature, and are not aggregated from user reviews. Each staff reviewer at Merchant Maverick is a subject matter expert with experience researching, testing, and evaluating small business software and services. The rating of this company or service is based on the author’s expert opinion and analysis of the product, and assessed and seconded by another subject matter expert on staff before publication. Merchant Maverick’s ratings are not influenced by affiliate partnerships.

QuickBooks Support

However, self-employed persons should consider Self-Employed—unless they have an employee, which will require an upgrade to Simple Start. If your business is service-based without any inventory, then Essentials should provide everything you need while saving you $30 per month compared to Plus. QuickBooks Advanced has many bells and whistles compared to Plus, but there are no additional features that are crucial to good bookkeeping.

QuickBooks includes at least 20 types of prebuilt reports as well as custom reports in certain plans. Sign up for QuickBooks Time through Fourlane today and get 30% off. Easily track time, save on payroll, and manage your team on the go. Ditch the shoebox of receipts and let QuickBooks track potential tax deductions for you.

This influences which products we write about and where and how the product appears on a page. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. Mileage tracking is available on QuickBooks Self-Employed and QuickBooks Online on iOS and Android only. QuickBooks MTD software currently supports Standard, Cash and Flat Rate schemes. Businesses whose home currency is not GBP are currently not supported.

In stark contrast to QuickBooks Online, each Xero accounting plan includes basic inventory management and an unlimited number of users. Xero’s software is easily as user friendly as QuickBooks’ with a colorful, organized dashboard and highly reviewed apps for iOS and Android. It also has better customer service reviews than Intuit, even though Xero’s customer service is available via email only. An easier way to manage different prices for different customers is with the price levels feature in QuickBooks.

With QuickBooks Payments, you’ll see money in your pocket more quickly. Enterprise automatically updates and sends payments directly to the bank, so you’ll always know what your bottom line is. When your inventory is under control, you can rest easy and focus on the rest of your business.

QuickBooks Online Plans Comparison: 2023 Pricing & Subscription Levels

Their mobile app for iOS and Android devices ensures you get all the essential capabilities that QuickBooks Online provides. For one thing, it limits the number of invoices its customers can send each month to 20 with the cheapest plan. The lowest-tier plan users are also limited to managing just five bills a month and creating 20 estimates a month.

However, it removes the limitations on the number of classes, locations, and chart of accounts, making it ideal for businesses with a growing staff. QuickBooks offers a free one-on-one meeting with a QuickBooks ProAdvisor for new users. Your ProAdvisor will help you set up your company file, including adding your business information, setting up accounts, and connecting your bank accounts. QuickBooks has partnered with payment processors like PayPal, Stripe and Square.

If you are self-employed and report income on Schedule C of your personal income tax return, the QuickBooks Self-Employed plan will likely make the most sense. Manage multiple businesses with one login with Quickbooks multi-files. Run multiple accounts with one login, one password, and at a discounted rate. QuickBooks Online pricing does not include all the 750+ apps, third-party tools, and other bonuses that you can benefit from. However, it does provide the base for you to access them without integration hassles.